Nine years have not been enough to change an alarming statistic for entrepreneurs and venture capitalists. In 2012, a Harvard Business School study revealed that 75% of startups close without ever giving a return to their investors. Now, this year, CB Insights found out that little has changed: 70% of startups also close without giving a return to those who put money into them.

And the problem is not just that the companies close. They close prematurely, especially in Brazil. According to a study by Distrito Dataminer, only 3.3% of the Brazilian startups that received investment between 2011 and 2020 reached the series C investment round, when the investment goes into the hundreds of millions of dollars.

If we research all sources, by the way, it is even better if startups never fly. Look at what journalist Deborah Gage, writing in the Wall Street Journal, says:

It looks so easy from the outside. An entrepreneur with a hot technology and venture-capital funding becomes a billionaire in his 20s. But now there is evidence that venture-backed start-ups fail at far higher numbers than the rate the industry usually cites.

What to do in the face of this scenario? Because startups have entered the market scene as a new model — faster, freer, solving classic problems that the traditional industry could not solve, and also solving new market problems that the traditional industry cannot even foresee.

After all, how in the mainstream industry model, which operates within classical paradigms, could companies like Uber, Facebook, Tinder, and innovative B2B companies from the world of the tech suffix (healthtech, fintech, insurtech, etc.) exist? After the global trauma of the 2008 crisis, it became clear that the market, in the framework in which it functioned, could not prevail. A new kind of company was needed, and startups, especially after the success of companies like PayPal and Facebook itself, seemed to point the way.

The conception of these companies could be done in a bootstrap format, without much initial capital. And, as I said, they met the needs of the new world. If we are, as people say all the time, in the era of customer-centrism and personalization, if the relaxed format of experimentation that characterizes companies like Spotify or Netflix (and the book No Rule Rules, by Reed Hastings, founder of Netflix, is the bible of this thesis), which allows even a “hyper-personalization,” as author Blake Morgan says, in Forbes, then we are really in a “blue ocean” moment, as authors W. Chan Kim and Renée Mauborgne, in their book Blue Ocean Strategy.

Only it hasn’t been happening that way.

Why?

How do you evaluate the mount

Here’s what Tom Eisenmann, author of the book Why Startups Fail? said in a recent article in the Harvard Business Review:

My findings go against the past assumptions of many venture capital investors. If you ask them why start-ups fall short, you will most likely hear about “horses” (that is, the opportunities start-ups are targeting) and “jockeys” (the founders). Both are important, but if forced to choose, most VCs would favor an able founder over an attractive opportunity

It is striking that in a context like 2021, where we talk about the power of data analysis, of objective and scientific evaluation of theses and performances, personalism is still a predominant force when a venture capitalist decides in which company he will invest his money.

However, from what we see, this is the case. The jockey has precedence over the horse.

The point is that a good jockey riding a bad horse cannot do much.

And how do you evaluate a horse?

Before answering that question, let’s look at a fundamental fact:

According to another CB Insights report, there are eleven main reasons why a startup fails:

- More resources were needed (38%)

- The market didn’t find the product needed (35%)

- The competition did better (20%)

- Business model was wrong (19%)

- Legal/regulatory problems (18%)

- Bad pricing/bad costing (15%)

- The team was not right (14%)

- Timing was lost (10%)

- Product was weak (8%)

- Disagreements between management and investors (7%)

- Pivoting didn’t work (6%)

The two main problems pointed out are the lack of resources (38% of the cases) and then, in second place, the market did not find the product needed (35%).

Although they may seem like separate things, they are not. In reality, they are extensions of the same problem: the poor execution of a Product-Market-Fit.

And this is the real fault of the startups that fail, in the vast majority.

Product-Market-Fit: What it is and how to do it

Is it possible to sail a leaky boat? Maybe, for a while, if everyone can get water out faster than it comes in. But then that is energy that could be being used to operate the helm or to row.

That’s the image that came to mind when I read this statement from Eduardo Sangion, Product Management Executive at CI&T: “The difference between success and failure in the hyper-growth phase is not about whether I have the money to execute, it’s about power and speed of execution.”

And what does this have to do with Product-Market-Fit? Everything. Because product-market positioning and allocation is precisely what makes developing the power and speed to execute your project in a sustainable way more likely to succeed. It is what makes your horse a good component in the race.

Product-Market-Fit is nothing more than the analysis that incorporates at least two elements: the quality of the product and the quality of the market where it will be positioned. There may also be a third element: the viability of the business (i.e.: Will it be profitable/Do I have funds to implement it?).

When I say that this area suffers from a certain lack of attention, I am not saying that entrepreneurs do it in a way that leaves something to be desired. On the contrary! Many times the analysis, the abstract or theoretical part of this period that is correctly perceived as critical for the company, is done in an excellent way.

The problem is that the horse trot slows down after this part. And then it is as if the Product-Market-Fit has been done badly. There is a gap between what should be done and how the company was set up or is performing at that moment. What the company has at that moment does not fit with the Product-Market-Fit found. And it is impossible to grow in scale without it.

Interestingly, this reminds me of what Gabriel Weinberg and Justin Mares, the founders of DuckDuckGo, talk about in their new book, Traction. “Traction is powerful,” they write. “Technical, market, and team risks are easier to address with traction. Fund-raising, hiring, press, partnerships, and acquisitions all become much easier.”

The curious thing is that many entrepreneurs start with traction for initial growth, but not for explosion; that is, they don’t grow to scale.

How to turn a product into a business

The impression I have is that many entrepreneurs think in terms of product, not business. There is a product that is offered, begins to be successful, and when it reaches the million-mark of users, it seems that it “can’t do legwork.” The horse cannot run to the finish line.

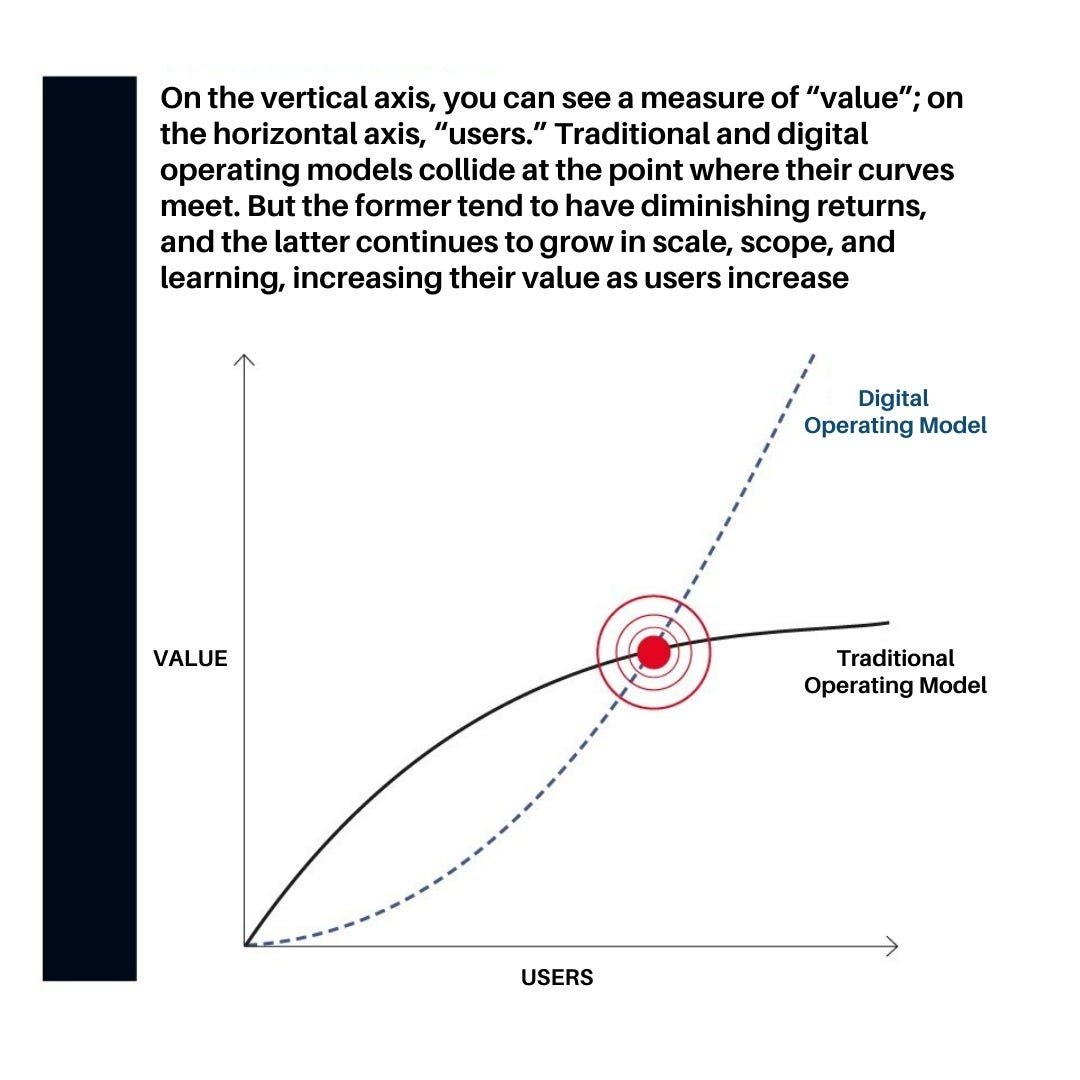

There is an issue of awareness here. As I mentioned earlier, there is an understanding — and even a promise — that the business model of startups is superior, or at least more suitable, for the market moment today. This can even be demonstrated graphically, as authors Marco Iansiti and Karim Lakhani did in the MIT Sloan Management Review Brazil in May this year. Check it out:

The problem is that, as I pointed out, most of these companies fail. But, if you paid attention, they fail because of success. Hypergrowth will come — but they have not prepared for it.

And how can you prepare for it?

It all depends on professionalization. The gap between planning and reality lies exactly in the question of professionalizing the people, the team, how the team should act so that the market continues to accept the product as more and more people assimilate into the sphere of users of your product.

See what Paulo César Teixeira writes in the article “How to Scale Your Digital Product,” also published by MIT Sloan Brazil:

“If, in the early stage, the product was a mere reflection of the founder’s vision, and in the product-market-fit stage, some process and performance metrics were defined around it, in hypergrowth, everything goes further.”

to if you are in the hyper-growth part, congratulations. You have succeeded in growing your user base. Now all that’s left is to grow your management, production, and positioning capabilities within the company.