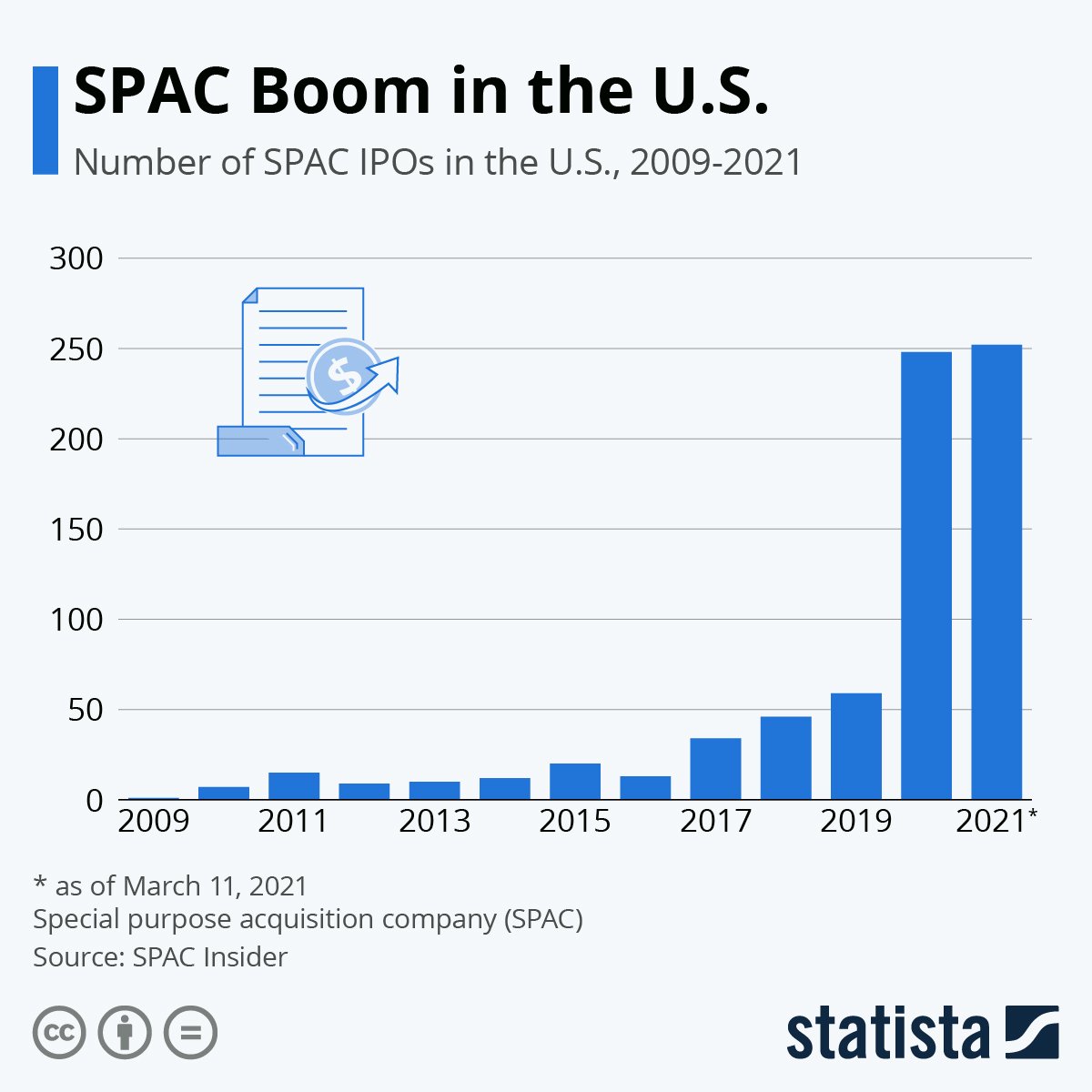

Despite their spectacular rise over the past few years, SPACs are still relatively misunderstood by market participants.

To put simply, a SPAC (Special Purpose Acquisition Companies) is a blank check company that provides an alternative route for private companies to become publicly listed. At IPO, the sponsors raise money into a readymade ‘stock’ to pre-fund an acquisition of, or merger into, a private company.

Technical Structure

Now there is a little more to it. By convention, all SPACs IPO at US$ 10, with an Equity and a Warrant component (and less frequently, a right to buy more). They are exchange-listed and all proceeds from a new issue are placed in a custodial trust account which accrues short-term interest rates while the sponsor team look for a potential target for acquisition. The trust is domiciled either domestically or abroad. Some structures have working capital draws for teams, the better ones do not. A deal must be closed within 18-24 months (sometimes with limited extension options). By the end of year two, the owner would therefore have US$ 10.50 (25c pa interest).

The owner would also own a ‘free’ warrant, typically worth $1-2 per share. Traditionally the warrant has a five-year life at closure and will be struck between $11.00 -12.50 per share (i.e. 10-25% out-of-the-money) convertible into different quantities of underlying equity post deal completion (typically a third to a full share warrant) - approximately 90% of structures do a deal, so warrants tend not to expire worthless.

Historically, interest rates were zero, so up until recently all returns to holders came from the warrant, i.e., equity options with a strike price of US$ 11.50, capped anywhere between $18.50 to $25.00, and on some occasions, not at all. Rights convert into a tenth of a share on deal completion.

Some SPACs even have premium redemption where the trust is redeemable north of $10 should a sponsor agree to fund the unit to demonstrate their confidence in finding a good deal. Many of the higher quality deals now come with forward purchase agreements of back-end capital commitments (funded by the entity tied to the sponsor or the sponsor themselves) that improve the probability of a successful acquisition. By the sponsor committing capital, they’re putting skin in the game and giving the impression they’re motivated to make the deal work.

Clearly, there are several variations of the core SPAC structure. Each deal is unique and going through the documents, i.e., doing the fundamental work on the different components, can make a big difference on how much return could potentially be generated in the different scenarios.

Investment Opportunity

For a deal that meets the minimum requirements (i.e., the structure is tight and there are no loose ends with working capital trusts) a sophisticated investor could trade across the capital structure and even structure a hybrid instrument with a deal team to ensure a “Yes” vote on a deal. This would mean doing the bottom-up fundamental work and then trying to secure a deal with the sponsor for convexity. Alternatively, investors could also rotate the equity or unit investment into a convertible preferred or bond.

A key opportunity in SPACs is the redemption feature. Should a deal be announced, shareholders have the right to vote on it. If they don’t like an acquisition, they receive their money back at par plus interest i.e., $10 + trust interest accrual. Shares are redeemable at the earlier of the two-year expiration or consummation of a deal (i.e., convexity to IRR through early deal announcement). There are no drag-along provisions, if a shareholder wants their money back it is their choice alone.

Additionally, given that the units are normally separable into multiple pieces and trade independently with tickers on exchanges, arbitrageurs could purchase equity instruments (i.e. bundles of short duration treasury bills with ‘jump’ and deal upside), or warrants, or hold/trade the units that embody the sum of these constituent parts.

There are nuances to the structures which is of course, where an investor's expertise comes in. Depending on their view of the sponsor team and the pricing and duration of those different instruments, they could create a number of different likely outcomes to profit from.