But there are a few things to consider when you are deciding on the amount of equity a startup advisor should be given.

The amount of compensation that you give to your business advisor will depend on many different things. These include:

- The advisor’s expertise.

- The role of the advisor in the company.

- The stage of the company.

This article will look at the amount of compensation you should give your startup advisor based on these factors. It will also explore the ways that MentorCruise can help to connect mentors and mentees.

What Is a startup advisor?

Before we dive into startup advisor compensation, let’s have a look at the role of a startup advisor.

A startup advisor, also known as a business advisor, is a paid professional whose role is to guide the direction of companies. These advisors are hired to work alongside executive members of the company and founders to give advice and guidance on the route that the startup should take and their next steps.

Due to the nature of the role, a startup advisor will need to be knowledgeable in the industry so that they can use this expertise to offer insight and guidance that the company would not otherwise have access to.

Business advisors will usually give advice on:

- Things the new company would benefit from investing in.

- Possible hiccups the company may face.

- Fill in gaps in knowledge that may be present.

- Unpack existing issues.

Mentors and consultants do a similar job to a startup advisor, but their roles are slightly different.

- Mentors are similar to advisors but they are unpaid and much more informal.

- Consultants are paid in cash and are hired for specific reasons.

First, a few questions to ask…

Choosing the right startup advisor could be a make or break decision for your company. This is where MentorCruise can come in useful as they can help you to find an advisor who has appropriate experience and expertise to support your business. You can find out more about the available mentors on our site.

There are a few questions that you should ask before a startup business advisor is paired with a company. These are:

- Do you think this advisor can bring value and expertise to the company?

- Are they excited by the company and do they believe in your possible potential?

- Do they have the time needed to put into this business?

Matching the right mentor to your company is very important as you want to ensure that you can get as much help as possible from them. If you’re looking for a mentor and want the expertise of MentorCruise to help you, book a session today.

Why do advisors need to be compensated?

There are a few reasons why advisors will need compensation for their role in your company. These are:

- They need to receive payment for the service that they are providing and for the time they are dedicating to your business.

- By giving the advisor compensation, you will be giving them a personal motive to want to help you. This is why giving them some investment in your business is a good way to motivate them to want your business to succeed.

Startup advisor compensation best practices

Advisor equity compensation criteria

Startup companies award their advisors with equity by restricting certain stocks. This is so that the stocks can’t be sold except to the advisor. Usually, if stocks are given out as compensation for the advisor, these will be forfeited if their role is removed.

When deciding how much compensation you are going to give to your advisor, you should consider these two things:

- Added value. Think about how much value the advisor offers the company.

- Company value. If the company is quite big, then they will require more complicated guidance.

Cash vs. equity compensation

Compensation usually comes in one of two forms for startup advisors.

Cash compensation

Some advisors will be compensated for their time by receiving a salary, but this is pretty uncommon. Usually, businesses don’t have a lot of money to give out to advisors during the early stages. This is why equity compensation is a more common way that advisors are compensated for their time.

Equity compensation

Most advisors will ask for equity compensation in exchange for their expertise and guidance. This mode of payment is good for both the advisor and the business. It is great for the startup, as they don’t have to pay out for this guidance before their business has started making any money.

Instead, the payment will come later, when their business is doing well and the equity has grown. It is also good for the advisor because they will end up making a lot of money alongside the success of the business. This way of payment also ensures that the advisor has personal stakes in the company, and so would really benefit from their success.

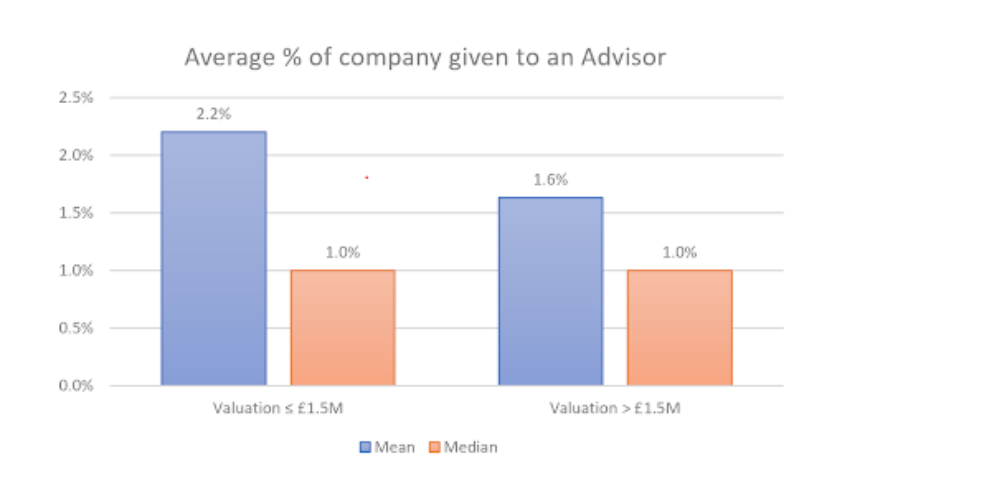

Refer to the graph below displaying the average percentage of the company that is given to the startup advisor through equity.

Different advisors levels

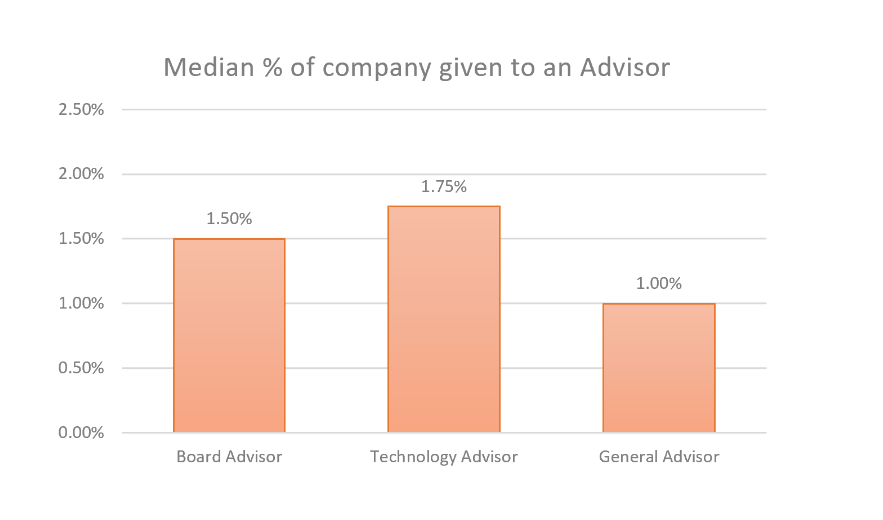

Depending on the roles, the amount of compensation they receive will also be different.

- General startup advisors are mostly compensated with equity alone. For instance, 81% of this type of advisor are paid with just equity. The other 19% are getting a mixture of cash and equity. 48% are compensated with just equity.

- Tech advisors are likely to get both cash and equity compensation. 36% of this group of people will get either cash or equity.

The graph below displays the median percentage of the company that is given to an advisor depending on these roles.

If you know what kind of advisor you would like and want to be linked up to one using MentorCruise, request an advisor today.

Create a startup advisor agreement

A startup advisor agreement contains certain information that both the business and advisor will need to be okay with before they start working together.

A startup advisor agreement usually includes:

- The duties of the advisor and what they will be responsible for.

- The length of the agreement.

- Confidentiality agreement.

- Compensation for the advisor.

In the agreement it is important to set benchmarks for the duties of the advisor. These will be specific to the individual advisor because every company will have specific needs. You should use a startup advisor agreement to set out standards for things like their availability. This way, you will know that you can call on their advice when you need it.

MentorCruise will help you to not only find a startup mentor for your company, but also to work out what you will need in your startup advisor agreement.

Final thoughts

Now you should have all the information you need about startup advisors and their compensation.