⧉ The Core Logic: Zero-Sum Games in Business

In strategic markets:

- If two players pursue the same opportunity, they compete head-to-head.

- One wins. One loses.

- If they target different opportunities, both may survive — but neither gains dominance.

When multiple such interactions occur sequentially, the total outcome defines who captures long-term advantage.

Where:

- vi = payoff (or deal win) from each competition.

- V = cumulative market advantage.

- Gj = Distinct market “game”

👉 A single victory doesn’t define market leadership — consistency across multiple deals does.

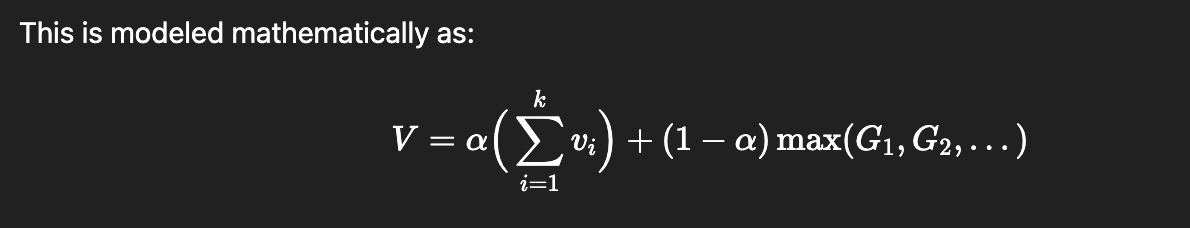

Now, in parallel markets, where players can pick different lanes, the payoff shifts to:

That means success isn’t about brute-force wins; it’s about selecting the right battles — the markets, ICPs, or geographies where your probability of success is highest.

◈ The Sales Strategy Connection

In every company, sales teams operate within invisible games. Some are repeated games (selling to similar accounts again and again), while others are parallel games (branching into new markets or ICPs).

- Startups often misinterpret the game they’re in. They chase large deals without the leverage to win them.

- Mid-market players that understand zero-sum dynamics build predictable compounding wins by improving marginal efficiency.

- Enterprises often prefer parallel play: carving markets where they don’t need to fight at all.

The art of GTM strategy lies in knowing which type of game you’re playing — and when to switch the board.

▣ Vertical SaaS: The Series of Zero-Sum Battles

Vertical SaaS companies — those serving a specific industry such as construction, logistics, or healthcare — play the purest form of the zero-sum game.

Every deal feels like a direct contest. The ICP is narrow. Customer pain points are identical. Evaluation checklists are nearly the same across vendors.

Take the construction SaaS market, for example. Two vendors might be pitching the same contractor network, using similar messaging, comparable pricing, and almost identical proof-of-concept stages.

This is the series model in action:

If one vendor wins 60% of deals and another 40%, that small difference compounds massively. Every win brings referenceability, renewal momentum, and network effects that make the next deal easier.

📊 A 5% increase in win-rate, if sustained, can shift a company’s market share trajectory entirely within 12 months.

Strategic Story: Imagine two companies — both with similar products. Company A wins a few high-value customers early, builds implementation case studies, and earns industry credibility. Company B, despite comparable technology, loses early momentum. By year two, Company A starts commanding trust, pipeline volume, and better CAC-to-LTV ratios. Both started equal — but because one played the zero-sum game slightly better, the compounding made it unstoppable.

Strategic Insight:

- GTM in vertical SaaS is about win-rate optimization.

- Marginal gains in closing, demo conversion, or deal cycle efficiency create long-term advantage.

⬡ Horizontal SaaS: The Hybrid of Competition and Coexistence

Horizontal SaaS spans multiple industries — collaboration tools, CRMs, analytics platforms, or cloud suites.

They operate in a hybrid world — where zero-sum battles and parallel expansion coexist.

Example:

- Slack gained traction among startups and mid-market tech companies through product-led growth and developer integrations.

- Microsoft Teams scaled enterprise adoption via bundling within Microsoft 365 and enterprise IT lock-in.

At first glance, they don’t seem to compete directly — but strategically, they both fight for the organizational communication layer. The company that controls that workflow controls retention, integrations, and cross-product stickiness.

This dynamic creates a hybrid payoff structure:

Where:

- α = proportion of overlapping markets (zero-sum).

- 1−α = proportion of non-overlapping markets (parallel).

- Gj = Distinct market “game”

Strategic Story: In 2019, many companies used both Slack and Teams. But over time, corporate IT leaders standardized to one — whichever ecosystem fit their strategy better. Slack didn’t lose to a better product — it lost to ecosystem gravity. Microsoft didn’t win every direct battle, but it avoided most of them by owning distribution.

That’s the key to horizontal success — not fighting everywhere.

Strategic Insight:

- The best horizontal SaaS companies learn to segment markets and avoid unnecessary overlap.

- Ecosystem integration, pricing strategy, and positioning decide where to engage — and where to yield.

🛠️ Services: Mostly Parallel, Occasionally Competitive

Services businesses — consulting, IT, engineering, or workforce solutions — operate in markets where collaboration outweighs confrontation.

Two firms can serve the same enterprise simultaneously — one doing cloud transformation, another managing support or data migration.

Unlike SaaS, where technology standardization leads to market dominance, services thrive on diversity and depth.

Strategic Story: Think of two consulting firms working with the same telecom client. One runs the AI roadmap; another handles process automation. Both win without colliding. But if both go after the same RFP with identical deliverables, the game instantly turns zero-sum.

Strategic Insight:

- Growth depends on scope differentiation — not displacement.

- Deep specialization and partnerships drive expansion better than competitive pricing.

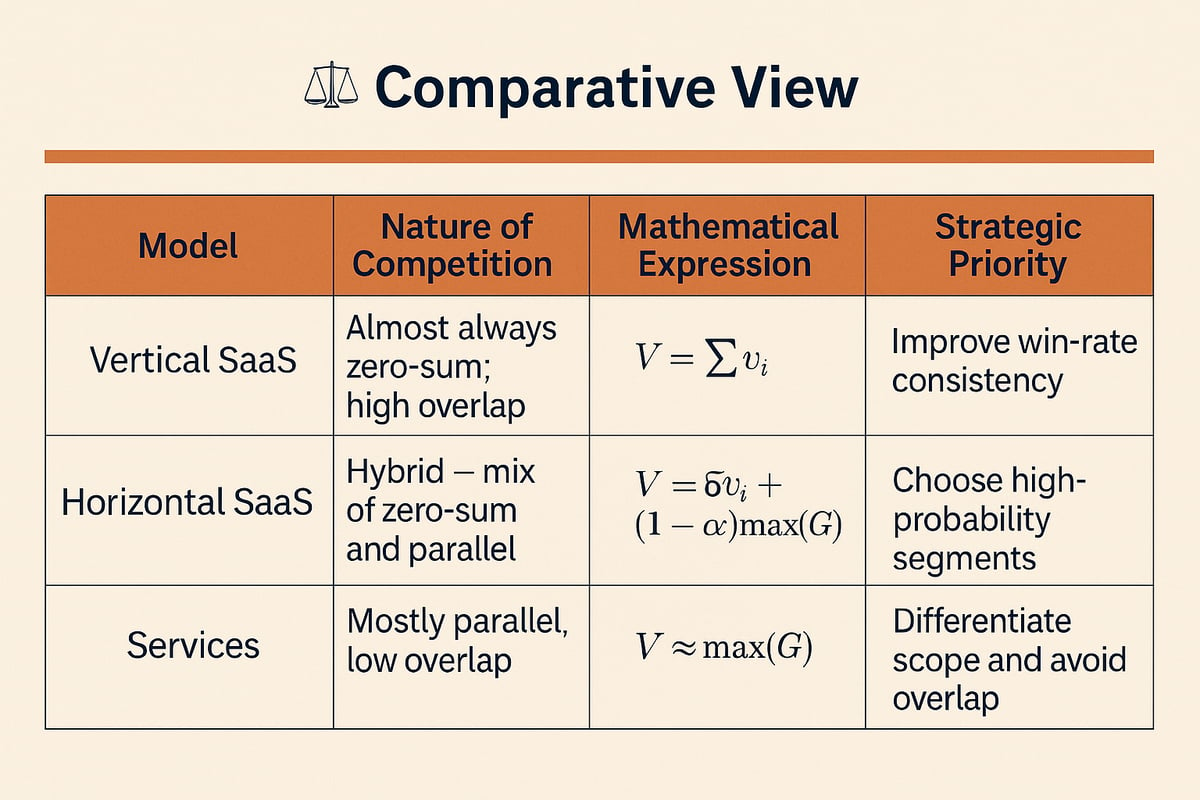

⚖️ Comparative View

⯀ Final Thought

Every market likes to call itself a “blue ocean.” But in practice:

- Vertical SaaS plays a repetitive, measurable game of survival — small advantages compound exponentially.

- Horizontal SaaS lives in a hybrid world — balancing confrontation with intelligent segmentation.

- Services thrive through cooperation, specialization, and adaptability.

The math doesn’t just predict who wins — it explains why some companies keep compounding advantage while others plateau.

💬 Closing Reflection

If you’re designing a GTM motion, ask yourself:

“Am I optimizing for a series of zero-sum wins — or am I choosing smarter, parallel lanes?”

Sales is no longer just about chasing deals — it’s about understanding the type of game you’re playing.

References

- Zero-Sum Game — Wikipedia A general definition and properties of zero-sum games in game theory. https://en.wikipedia.org/wiki/Zero-sum_game Wikipedia

- Game Theory Strategy: How It Improves Decision-Making — Investopedia Covers game theory fundamentals, including zero-sum vs non-zero-sum, strategy, etc. https://www.investopedia.com/articles/investing/111113/advanced-game-theory-strategies-decisionmaking.asp Investopedia

- Vertical SaaS Definition — TechTarget A useful industry-level explanation of vertical SaaS and how it differs from horizontal SaaS. https://www.techtarget.com/searchcio/definition/Vertical-SaaS-Software-as-a-Service TechTarget

- Vertical SaaS vs Horizontal SaaS: Key Differences & Benefits — AceCloud A recent breakdown of pros, cons, tradeoffs between vertical and horizontal models. https://acecloud.ai/resources/blog/vertical-saas-vs-horizontal-saas-differences-benefits/ AceCloud

- The Future of Vertical vs Horizontal SaaS and AI — Asymm A forward-looking piece discussing how vertical/horizontal SaaS may evolve. https://asymm.com/the-future-of-vertical-vs-horizontal-saas-and-ai/ ASYMM

- Vertical Software Is Having a Moment — Activant Capital Why investors and the market are leaning toward vertical SaaS today. https://activantcapital.com/research/vertical-software-is-having-a-moment activantcapital.com

- Strategies for Zero Sum and Non-Zero Sum Games — Medium Explores mixed strategy equilibria and strategic decompositions, useful for linking game theory to sales strategy. https://medium.com/data-science-in-your-pocket/strategies-for-zero-sum-and-non-zero-sum-games-in-game-theory-7d4aeac0f2c8