At MentorCruise, we’ll teach you the basics of startup fundraising.

In this article, you’ll learn:

- Why would you need funding for your startup?

- The startup valuation process

- How should you approach startup fundraising?

- Where you can find funding for your startup

Why your startup needs funding

Here’s the ugly truth: Without funding, most startups fail. That’s because profitability is hard. Sometimes, in order to successfully execute on your go-to-market strategy and keep your operations running, you need more money than what you currently have.

Many high-growth companies, which startups are, initially need to burn capital to sustain their growth before achieving profitability. Having enough funds also means being able to hire specialists to help you grow, such as marketers, salespeople, product managers, and so on.

Fundraising for startups is a difficult process. It’s complicated, takes a lot of nerves, and can really affect your sense of self once the rejections come rolling in.

Despite all that, it’s a path that almost every entrepreneur has to take.

When should you start fundraising for your startup?

The answer to this is pretty straightforward. You should start raising funds for your startup once you have figured out the right market opportunities for your product, who your customers are, and when the product is already getting some traction.

Important: If you want to raise venture capital, you need to understand how VC firms work and how big of a market size they want you to acquire with their funding. You’ll quickly realize that VC’s don’t like to invest in startups that don’t have a clear potential to grow big.

Having a fundraising mentor can also help you figure out how to navigate the tricky world of investing.

Startup Valuation Process

The startup valuation process differs from the valuation for more established businesses. The former typically happens when a startup is in its pre-revenue stage or when it’s just getting into profitability. As such, there are no numbers to base your estimations around, such as net profit, interest, taxes, depreciation, and so on.

As a startup founder, to start the process of calculating the value of your startup, you need to understand your total addressable market, the competitive landscape in which you’re operating, and the value of your time and that of your employees.

Investors typically prefer to invest in startups with proven traction (which you can calculate through revenue growth rate, customer growth, recurring revenue, and so on) and high-profit margins.

Here are some ways to calculate startup valuation, especially in its pre-revenue stage:

- Berkus Method: The startup’s value is assessed in 5 different areas, namely concept, prototype, quality management, connections, and launch plan.

- Payne Scorecard Method: Here, the startup’s value is compared with similar companies that have been funded.

Valuating your startup is a necessary process to start the fundraising process. Understanding the valuation of a startup helps investors decide whether they want to help your startup or not.

Different rounds of startup funding

Generally speaking, the startup fundraising process can be divided into 5 stages.

#1. Pre-seed round

Many startup founders initiate a Friends and Family round to get funding from existing relationships who have faith in this startup’s potential to succeed. During the pre-seed round, most founders have a bare-bones version of the product to show how it works, are just hiring its first employees, and have identified a market opportunity to tackle.

Of course, there are many risks in investing at such an early stage because there’s no certainty that the product will even go to market. Therefore, the cash injection is much lower compared to the next rounds. Nonetheless, it can serve as an essential push to help founders hit the ground running.

#2. Seed round

In the seed round, the startup has gotten initial traction and is now looking for angel and institutional investors to fund the startup.

Sometimes also referred to as the angel investor funding round, seed funding helps the company scale growth and hire the right people to build various processes. The amount of funding can range between $50,000 to $2 million.

#3. Series A

Also called the venture capital stage, at this stage of funding, the startup must have found some momentum in the market and is now looking for ways to grow fast. Series A and the next ones mainly consist of equity-based financing, meaning that investors provide money in exchange for company shares.

As of 2020, the average amount of investments stands at around $15.6 million. Therefore, this is the first significant round of financing for many companies. It can help many founders 10x their processes and scale their processes.

#4. Series B

With the consent of Series A investors, startups can then initiate a Series B funding round to grow into companies that operate at a larger scale.

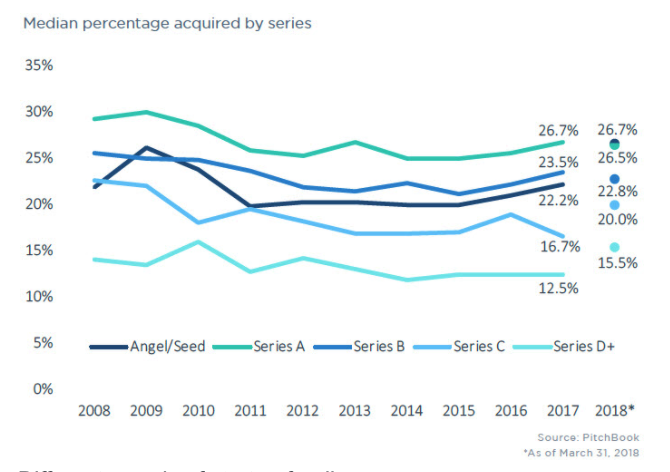

The investments in Series B rounds are often larger, from $7 million to upwards of $50 million. Series B companies have more accurate valuations as calculated from financial records, can sustainably generate revenue, and are profitable. As companies typically are worth more than in the previous rounds, investors get less equity.

#5. Series C

At this stage, startups are now well-established companies looking for financing to enter new markets, fund research and development, and acquire other companies.

There’s less risk involved in funding Series C companies, as they already have solid revenue and profit. Therefore, during a Series C round, large financial institutions, such as hedge funds and investment banks, tend to participate in this round.

How to approach startup fundraising

Fundraising is an important part of having a startup, and it’s arguably the most exhausting part. Fundraising is not linear, and it can take a lot of valuable hours you could spend doing something else. Hopefully, these tips will help bring clarity to your fundraising strategy.

#1. Ask yourself why you want to raise funds.

This strategy outlines how you plan on raising funds. Ideally, it’s in a form of a written document that isn’t too long or too elaborate. A good strategy answers these five questions:

- Why am I raising funds?

- Do I need to raise funds?

- What types of investors can I attract with my product?

- How much money do I need to raise in the next 6 months?

- What successes do I need in order to raise more funds?

- What will happen if I don’t raise funds?

- Who can help me in startup fundraising?

#2. Have the right documents.

While startup valuations are typically more speculative than valuations for more established companies, it still pays to document your processes and what it takes to grow your startup into a sustainable business.

As such, you may need a 1-page executive summary detailing the most important things to know about your business, from product description to your key customer segments. You also need to create a pitch deck — the more visuals, the better — so that you can explain how you intend to grow this startup and why there’s a hot market opportunity to take advantage of.

In these documents, you should also show how you want to grow your team and highlight existing members’ expertise to show credibility. Investors may want to see how this financing will lead to establishing processes that generate growth.

#3. Understand why investors would want to fund your venture.

A big mistake that founders often make when getting into startup fundraising for the first time is not doing adequate research on the types of financing in their reach. Founders might either stop at the Friends and Family round or try to get into seed funding without understanding the industry they’re operating in.

As a founder, you need to understand that your own network may not be a good place to get funding, and expanding into the peripheries may unlock possibilities that you might not have thought of.

Check investment patterns within your industry and how similar, more-established companies have been financed. Discovering investment patterns may help you uncover investor networks that are a perfect fit for what you’re trying to build. After all, just because someone has money does not mean that they’re the right investor for you! If you onboard an investor whose values you disagree with, you may end up having a startup you don’t want to grow anymore.

Investors also hold much more value than the capital that they can offer. They have a wealth of knowledge in growing companies and may help you operationalize your processes and even find the right people to hire.

#4. Decide how much you want to raise.

Define how much you want to raise based on:

- The amount of time it will take to reach profitability. This can depend on various things, such as your product roadmap, your month-on-month revenue growth, and so on.

- Your total monthly costs. From paying your hires to capital expenses, knowing your monthly costs will help you figure out the right amount of money that you need to break even (or grow until the next funding round).

Profitability is the primary goal. If you’ve managed to reach a semblance of profitability and product-market fit, fundraising becomes a much easier process in the next rounds.

Of course, startup fundraising always involves giving up a % of your company. As a company becomes bigger, the total shares increase and result in stock dilution. You want to persuade investors that their money has a chance to grow in the future.

#5. Plan, pitch and revise.

In the process of pitching to potential investors, you’re most probably going to be rejected — a lot. Take this as a learning experience to understand how you can better refine your pitch deck and way of selling your product.

You also need to understand that your pitch deck is primarily a sales document. It shouldn’t detail everything about your product, the market, and the risks involved, or else you’re going to have a dull deck with over 50 slides.

In your pitch, you most importantly need to instill trust and confidence. You need to persuade investors that you have the right CEO to lead the company, the right team to build the product, and the right product to conquer the market.

However, do make sure to have answers to issues they might potentially raise after your presentation. While you shouldn’t get into the risks involved in your business venture during your pitch, you need to acknowledge them when they’re asked. Investors are more interested in investing in founders that have a thorough understanding of the market and the risks that exist in building the company.

Types of startup funding

From bootstrapping to crowdfunding to venture capital, you have a wide variety of options when it comes to startup fundraising, depending on what you want, your profit margins, and revenue growth.

- Bootstrapping: The scrappiest option to fund your startup is by bootstrapping from your savings or by doing a Friends and Family round. More founders who want ownership of their potentially high-growth businesses are increasingly resorting to this option. Of course, while this is a simple way to start your business and funds can easily be accessed, you won’t have a lot of capital to start with.

- Bank loans. Banks provide loans to people with a solid business plan and some data to prove their growth. They’re also a great way for entrepreneurs to access bigger types of funding.

- Crowdfunding is also increasingly becoming an option for people who want to raise funds and build a working version of their offering. Platforms like IndieGogo, Kickstarter, and Seedrs have made it easier for people to pitch to a group of interested strangers. Having said that, there’s a lot of competition involved, and your product will be closely examined against similar products that are also on the platform.

- Incubators and accelerators are programs that provide financial and mentoring support to promising startups. While incubators nurture businesses to make sure that the founder has the right resources to succeed, accelerators _accelerate _the success of startups that are showing promising signs of growth.

- Pitch competitions are exactly what they sound like. In these competitions, you get to form connections, find relevant investors and even win a cash prize. You may also get valuable media coverage.

- Angel investors are wealthy individuals who are ready to invest in your startup in exchange for equity. They typically look for a return of investment ranging from 25-60% and therefore are willing to take larger risks in the hopes that it pays off. Aside from that, they may also offer valuable mentorship and expertise that may help you grow your startup. Sometimes, angel investors form into groups and focus on investing within a specific geographical area or an industry.

- Venture capitalists also partake in equity but are more sophisticated in investing and prefer to fund businesses with a proven level of stability. Like angel investors, they offer a wealth of expertise, mentorship, and access to their networks.

Get startup fundraising help at MentorCruise,

In this article, you learned how to approach fundraising for your startup and where to find investors.

With our mentorship programs for startups, you can hone your business idea, get all your documents in order and become better prepared for pitching to investors.