Today we cover the topic of SaaS pricing strategy and the question of ‘What is the right pricing for my SaaS product and how to approach it properly?’.

1. What is SaaS Pricing?

The Anatomy of SaaS Pricing Strategy defines the price as the exchange rate on the value you’re creating in the world.

This means your SaaS pricing is more than just a simple number. A proper SaaS pricing strategy includes:

deciding on how much you charge (your price point) and

especially for what you are charging for (your value metric),

how you present the value to (segments of) the market (your packaging),

and at what terms (your billing, discounts, cancellation).

This means that your pricing is directly related to your ideal customer profile ICP (who do you target), your positioning in the market, your sales strategy (product-led vs. sales-led growth), and therefore ultimately a core part of your SaaS growth strategy.

2. Why is SaaS pricing important?

Your SaaS pricing is a key part of your SaaS growth strategy and directly impacts the growth of your business.

Joel York defines the growth of a SaaS company as the following:

SaaS Growth = Acquisition Rate x Average Customer Lifetime Value

Simply said, this means you can impact your SaaS growth by:

1. adding new customers

2. reducing the loss of existing customers (churn), and

3. increasing the revenue per customer (CLV).

And increasing the customer lifetime value (CLV) is a combination of keeping the customer longer (reducing churn) and increasing pricing (revenue per customer).

For each of them (but especially for the CLV) pricing is crucial. Without a proper SaaS pricing strategy, you miss out on a lot of revenue growth potential and risk high churn rates. You will most probably choose the wrong price point, poorly communicate the value of your product (because of the wrong value metric), and miss out on promising buyer personas because of wrong packaging and pricing tiers.

3. Different SaaS Pricing Models - value-based vs. cost-plus vs. competitor-based pricing

Cost-plus pricing

Cost-plus pricing is pretty simple. You are basically selling your product for a little more (e.g. 35% profit margin) than your costs. The big problem with cost-plus pricing is that your customers don’t care about your costs, they care about the value of your product. But of course, knowing how much it costs you to serve one additional customer (knowing your unit economics), helps you to figure out what’s the lowest price you can offer (and still be profitable). This is especially important if you have (high) variable costs for serving a new customer (e.g. high initial set-up costs like hardware or (high) performance-related variable costs (e.g. file storing costs)).

Competitor-based pricing

Looking at the pricing page of your competitors (competitor-based pricing) can be a good starting point for your own pricing and helps with benchmarking. It’s relatively easy to do (simply check the SaaS pricing page of your competitor and create a spreadsheet with all your competitors) and your pricing will most probably not be completely off. But the disadvantage of competitor-based pricing is that you’re following what your competitors are doing and not focusing on the things that make you special, better, and unique (your own key value proposition).

I would recommend focusing on your own pricing, following a value-based pricing strategy, and just looking at the competitors’ pricing for benchmarks (price point) if you’re in a crowded market (if so, think about ways how you can create your own (niche) market/category and re-position yourself, so you aren’t directly comparable with your (in)direct competition). If you are in a relatively crowded market (blue-ocean market) your price point needs to be competitive with your direct competition and can’t be completely off.

Value-based pricing

Value-based pricing is the recommended pricing strategy for SaaS companies. You are basically charging your customers for the value they receive using your product. The more value your customers receive, the higher their willingness to pay. In order to effectively run value-based pricing, you first need to really understand your customers (especially their needs and pain points), then identify the right value metric and price point, and work on your packaging and pricing terms.

With powerful value-based pricing, you will increase the profitability of your SaaS business and positively impact your LTV/CAC ratio. You will see how your customer acquisition costs (CAC) decrease and your customer lifetime value (LTV) increase. With the right scalable value metric and packaging (pricing tiers) in place, targeting different market segments (different ICPs and buyer personas) will get easier.

Also check out 10 SaaS pricing tips to learn more about popular SaaS pricing models like flat-rate pricing, usage-based pricing, feature-based pricing, and tiered pricing.

4. How to decide on your SaaS pricing?

SaaS pricing strategy process in a nutshell:

Step 1: Choose your value metric

Step 2: Determine the price point (10x rule, Van Westendorp model, LTV/CAC >3)

Step 3: Decide on the packaging

Step 4: Define your pricing terms (discounts, billing, cancellations)

Strictly speaking, it needs to start as step 0 with understanding your ideal customer profile and their main pain points (you are going to solve with your product).

Note: If you are just starting your business the exact price point isn’t as important as it is for later-stage companies. As Patrick Campbell said:

“In the beginning, the actual number you're charging isn't that important. There are some exceptions, but for the most part, you should first be figuring out the range you're in: a $10 product, $100 product, $1k product, etc. Don't waste time debating $500 vs. $505, because this doesn't matter as much until you have a stronger foundation beneath you.”

Step 1: Choose your Value Metric

A value metric is “something that a customer or prospect associates value with” (Chris Hopf). It’s basically what you charge your customers for. Typical value metrics in B2B SaaS are: per user, per bookings, per revenue, per subscriber, per views, and per storage (GB)….

Examples of value metrics:

Payment providers —> € Revenue generated / € Transaction volume

Email Newsletter Tool —> # of subscribers / # emails sent

Video hosting platform —> # videos uploaded / video storage (GB)

Deciding for the right value metric allows you to scale with your customers. This means the more value they get out of your product, the higher the willingness to pay and the higher your revenue. This is also true for the opposite: with the right value metric in place, customers using less of your product don’t churn, instead, they naturally downgrade and pay less (still accordingly to the value they receive). This also means that your product is appealing to different buyer personas and you’re charging accordingly (to the value they receive) and don’t just charge based on a flat fee so that small and large customers are paying the same.

So you are basically aligning your interest (grow revenue) with your customers’ interest (getting more value).

Or as pricing expert Patrick Campbell says

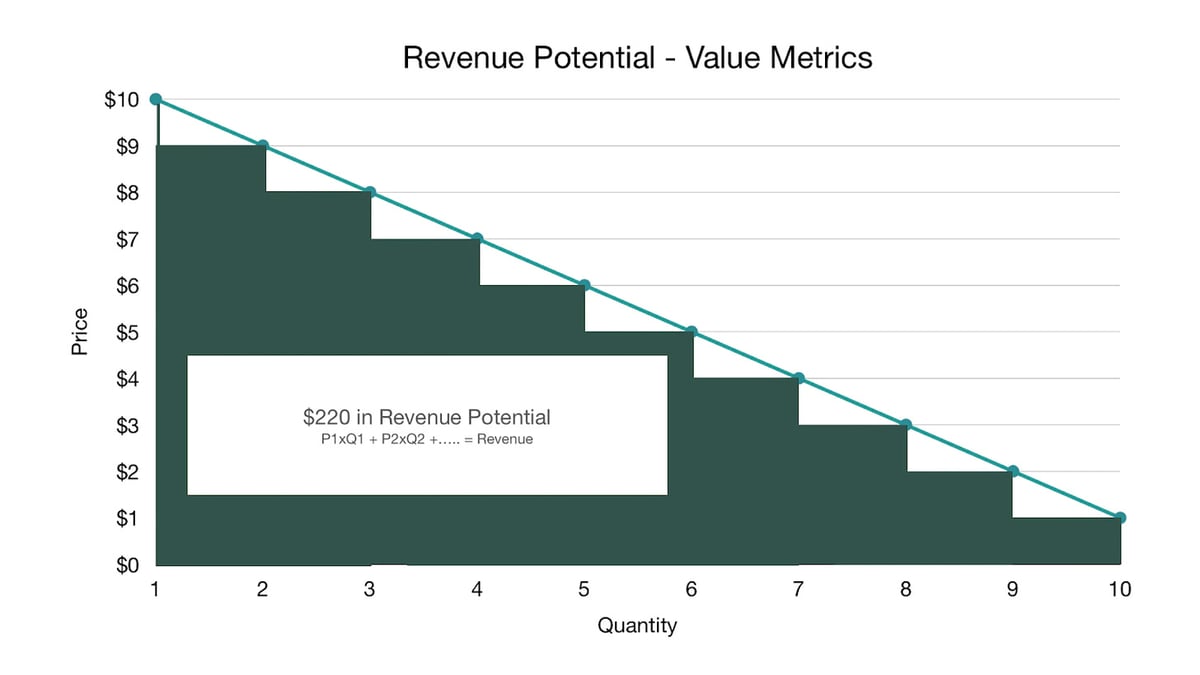

“a value metric however allows you to have essentially infinite price points — maximizing your revenue potential”.

3 essentials about a great value metric

Choosing your value metric is key, so make sure that your value metric is:

1. Easy to understand

Keep your pricing simple. Every prospect needs to understand your pricing. If your pricing is too complex or it takes them a lot of time/thinking to understand, you will lose potential customers (they will not sign up on your website OR aren’t convinced of the value during a sales demo).

If your pricing is good, prospects will immediately understand your pricing (especially the value metric), know which package is the right one for them, and how much they will pay for it (as they know how many of the ‘value metric’ they need, e.g. how many users, leads, bookings…). They will think “Yeah, this product is made for me and that’s the right plan for me”.

Exercise: If you are following a sales-led growth, ask your sales team to pitch your pricing to 10 prospects in under 30 seconds. If out of the 10, more than 2 prospects don’t get it, your pricing is most probably too complicated (or you have bad sales reps 😜). For product-led growth, share your pricing page with 10 prospects and ask them if they can pitch and explain you your pricing in their own words. If they fail, you know your pricing is not simple (enough).

2. Aligned with the value your customer receives using your product

Your value metric needs to align with the value your customer receives using your product.

It’s key to understand what your customers want. What is the objective and outcome they are looking for? What is the expected value (results) of your product for the customer?

As Tomasz Tunguz says, in B2B SaaS it will most probably be more revenue, fewer costs, or higher productivity.

So this means you need to measure and quantify the value - ideally you can do that (see Step 2: Determine your price point).

3. Grows with the customer’s usage of the product

The higher the usage of the product, the more of the value metric is used, and the higher the value of your product for the customers, which leads to a higher willingness to pay. So your revenue scales with the usage of your customers (e.g. for an Email marketing software: more emails sent leads to more revenue). This means you have a ‘built-in’ lock-in effect and prevent customers from ‘growing out of your tool’. This leads to lower churn and higher lifetime values (LTV).

Next, after you‘ve decided on your value metric, it’s time to determine your price point.

Step 2: Determine your price point

Your value metric needs to align with the value your customer receives using your product. This means you need to measure the value and quantify it (if possible). Quantifying the value of your product is super important.

If you can easily measure and quantify it (e.g. new revenue generated €), you should pick that as your value metric. In case you can’t, try to find the best proxy for the value that your product delivers (in 99% you will find a great proxy for the value). The best proxy for the value is your value metric.

Quantify your Value

If you’re just starting with your business, it’s hard to exactly know the value of your product as you don’t have lots of customer data, so try to estimate and calculate the value. A great way to do that is to apply the 10x rule.

10x rule

The 10x rule basically says that customers will buy your product if their return on investment is a minimum of 10x.

This means that you need to make sure that the value your product delivers is at least a 10x compared to what you are charging. If the value for the customers is below 10x, they are not convinced.

Here are some examples:

Our CRM tool helps Sales teams to close 20% more deals per month. We know on average our customer’s sales team closes 10 deals per month with an ARPA of 500€/month. This means we enable our customers to close 12 (instead of 10) deals per month, which results in 1000€/month more revenue. Based on the rule of 10x we can justify charging 100€/month for our tool.

Our invoicing tool helps freelancers to save time creating invoices by 50%. We know on average a freelancer sends 6 invoices per month and needs 30min/per invoice to create and send them. This means it takes 3h every month for them. Charging 150€/h as a freelancer, the opportunistic costs are 450€/month. Based on the rule of 10x we can justify charging 45€/month for our tool or better 7,5€ per invoice per month (opportunistic cost per invoice is 75€ —> rule of 10x = 7,5€ per invoice). This means the number of invoices generated per month is a good proxy for the value.

Our hr engagement software helps companies to reduce employee churn by 50%. Assuming that replacing an employee with a new one costs 6000€ (incl. lay-off costs, hiring costs, onboarding costs…) and your company has a 20% employee churn rate, you can calculate the value of your product. A company with 500 employees needs to replace 100 employees per year (without your software), which costs them 100*6000€ = 600k€ per year. Using your software reduces the employee churn rate to 10%, so they only need to replace 50 employees per year, lowering the related costs to 300k€ per year. The value of your product is 300k€ per year, so applying the rule of 10x, you can easily justify a 30k€ annual contract value.

Having already (lots) of paying customers and historical data, it’s getting easier to calculate the real value of your product. Is it true that you increase the sales efficiency by 20%? Can you really cut the time for invoicing by 50%? Talk to your customers, ask for feedback and measure the results of your product.

Another great method, especially for (later stage) companies that already have an established customer base, is the Van Westendorp method.

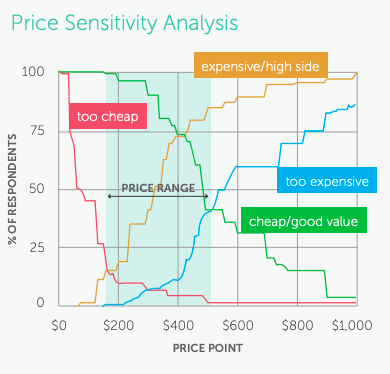

Van Westendorp Model

The Van Westendorp model is a customer research approach. Basically, you ask your existing customers in a survey about their willingness to pay and run your analysis based on the answers.

You will ask your customers 4 questions and based on the answers you can calculate (and visualize) your ideal price range. The 4 questions are the following:

1. At what price would you consider the product to be so expensive that you would not consider buying it? (Too expensive)

2. At what price would you consider the product to be priced so low that you would feel the quality couldn’t be very good? (Too cheap)

3. At what price would you consider the product starting to get expensive, so that it is not out of the question, but you would have to give some thought to buying it? (Expensive/High Side)

4. At what price would you consider the product to be a bargain—a great buy for the money? (Cheap/Good Value)

Analysis of the answers lets you calculate the ideal price range as well as at what price point you will maximize the revenue potential. Check out the Anatomy of SaaS Pricing Strategy for a step-by-step guide on applying the Van Westendorp Model.

Step 3: Packaging & Tiers & Addons

So now, as you know your value metric and the price point of your offering, you can put together different packages (your pricing tiers). That’s what you mostly see on different SaaS pricing pages.

Different customer segments receive different values from using your product and sometimes even value specific features over others. That’s why you should ideally offer 3 to a maximum of 4 different pricing tiers, each pricing tier represents a different segment of your customers.

Ask yourself if there are specific features that only a specific segment of customers need? Do you have features primarily relevant to small customers or large customers? Then only include those in the specific pricing tier. What are the core features everyone needs and also what features depend on each other? Do you offer features that are only relevant for special customers? Think about excluding them from your standard plans and offer them as add-ons.

Check out Jonas Rieke's article on data-driven framework for SaaS packaging.

When structuring your pricing plans keep in mind price anchoring. Including a relatively expensive pricing plan (mostly an Enterprise or Premium Plan) into your pricing, your other pricing tiers will look comparably cheap.

Step 4: Pricing Terms

The last step is deciding on your SaaS pricing terms. This mostly includes taking decisions on your discount policy, billing and payment options, as well as the cancellation policy.

Discount policy

You need to decide on your discount strategy. Normally you offer up to a maximum of 20% discount (better 10-15%) for yearly upfront payments (vs. monthly payments). For enterprise deals, you can also offer discounts on long-term contracts (e.g. 3 or 5-year contracts). If you are following a sales-led growth strategy, how flexible can your sales team offer discounts? Try to establish clear rules on discounting.

Billing (monthly, quarterly, yearly…)

What kind of billing options do you offer. For SaaS most common are monthly payments or yearly upfront payments. Does it make sense to offer quarterly payments as well? And most importantly what does the billing process look like? Do you make it easy for the customers to pay for your product (e.g. credit card payment) and is the pricing transparent and clear?

*Note: Check out subscription billing tools like Chargebee.

Cancellation

You need to decide on how your customers can cancel their subscriptions. Most startups offer monthly cancellation (for monthly paid plans). Along with the cancellation policy, you need to think about how customers can upgrade and downgrade during their contract? For yearly plans, the most common is that customers can upgrade anytime, while downgrading is only possible to the next billing date.

Grandfathering

Grandfathering is relevant when you’re deciding to update your existing pricing and you already have paying customers. Then you ultimately ask yourself the question of how to handle your existing customers? Do they need to change to the new pricing or do you offer them to stick to their existing pricing plan?

That’s where grandfathering comes in handy. Grandfathering basically means that your existing customers remain in your old pricing, while your new pricing is applied to all new customers. Of course, you should always offer your existing customers to switch to a new pricing plan - especially if you restructure your plans and can be beneficial for them.

Exercise: Now you know a lot about SaaS pricing. Check out 5 SaaS pricing pages of your favorite SaaS tools and try to analyze their pricing. Let me know what you discover.

5. SaaS Pricing best practices

Highlight one pricing tier (Isolation Effect)

The conversion rate of your pricing page is the highest if you highlight one of your tiers. People tend to decide on products that are highlighted or in some way 'isolated' from the rest of the options. A great way to do this is to highlight one tier with a badge (e.g. most popular), different color, or a frame.

Offer yearly discounts (10-20% discounted) & monthly payment options

Offer discounts for long-term contracts (e.g. yearly upfront payments). For your annual discounts, you can offer up to a 20% discount (don’t offer more than that). Based on Patrick Campell percentage discounts work less well than absolute discounts (e.g. 2 months for free). So think about offers like: Get 2 months for free (only pay 10 months instead of 12) for annual contracts.

Limit the pricing tiers to 3-4 (Paradox of Choice)

To keep it simple and easy to understand for your potential customer, limit the number of options they can choose from. It's called the paradox of choice - the more options they have to choose from the harder it's for them to make a decision.

Nudge your customers (price anchoring)

Price anchoring is a concept, where you leverage the fact, that humans use reference points to assess the price and value of something. Use smart pricing (nudging) to nudge customers for your preferred tier. One powerful way is to make your more expensive tier 'relatively' cheap compared to the cheaper options, so your customers get the feeling that this is a 'great deal'.

Transparent Pricing (only hidden for enterprise clients)

Unless you are selling SaaS to really large customers (Enterprise market) you should have a pricing page on your website with transparent pricing.

Don’t offer Freemium in the early stage

Freemium is a great acquisition strategy for later-stage startups that target a huge market. Freemium only works if you have a super large TAM (total addressable market) and is better for well-established players (e.g. Zoom, Dropbox, Slack, Calendly…). Jason Lemkin recently said that you need 50 million active users for freemium to actually work.

If you are early stage and offer a freemium plan, you will not know if your customer really values your product (and later on are willing to upgrade to a paid plan). So it’s better to go with free trials and paid plans.

Frequently work on your Pricing Strategy (at least 2x/year)

In most early-stage companies you don’t have a Chief revenue officer and the responsibility for pricing is mostly shared between product, sales & marketing. But shared responsibility also means most of the time no one really feels accountable and cares about it. This leads to almost no optimization and iteration of your pricing.

So first of all take a decision on who is accountable for pricing in your company. Then make sure to establish a culture where you at least twice a year work on your pricing strategy. Areas to experiment with are value metrics, price points (e.g. increase your prices), packaging (e.g. moving features to different tiers), and positioning (your customer segments), but also add-on features/services, discount strategy, billing options as well as specifics about expanding to new markets (e.g. new currencies) or new products (e.g. bundles).

Feel free to also check out my other article on SaaS pricing best practices for some practical tips.

Share the article with other SaaS founders or SaaS managers who can benefit from it for their own SaaS pricing.

References

This article is inspired by Chris Hopf (How to Identify your Value Metric(s) Using the Pricing Metric Decision Guide), Patrick Campbell (Pricing your SaaS product), Jonas Rieke (A data-driven framework for SaaS Packaging and Pricing), Peak Capital (7 strategies for pricing and packaging for your SaaS product), Jason Lemkin (Freemium is Back! But You’ll Need 50 Million Active Users for Freemium to Actually Work as a Business Model), Price Intelligently (The Anatomy of SaaS Pricing Strategy), Will Steward (How to price your SaaS Product).

🚀 3 more things

If you need support in growing your B2B SaaS business, feel free to reach out to me via Linkedin.

Do you want more content? Check out some more helpful resources and subscribe to my FREE bi-weekly Newsletter on Substack.

Give back time: If you like the content, give it a like and leave a comment below. Simply share the newsletter with others and help me to reach my goal of 3000 subscribers.